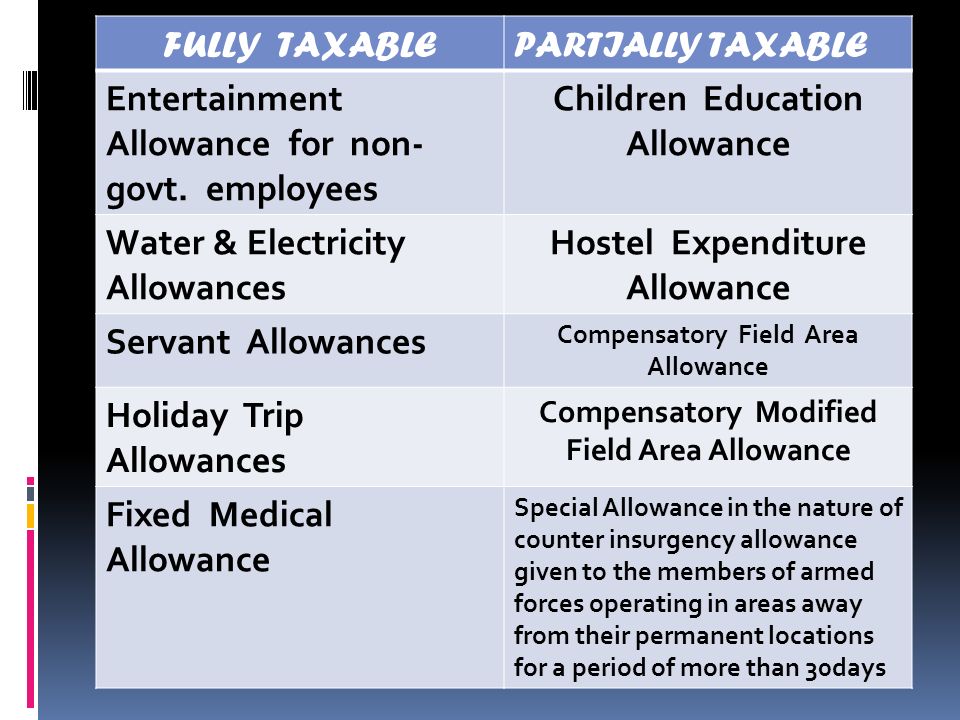

Well, let me tell you about this entertainment allowance thing for them government folks. It’s a bit of a head-scratcher, but I’ll try to make it simple, like I’m explainin’ it to my neighbor Mildred over the fence.

So, these government workers, they get some extra money. They call it an entertainment allowance. I reckon it’s for takin’ folks out to fancy dinners or somethin’. Now, when it comes to taxes, which is always a pain, there are some special rules for this money for the government employees.

First off, if you work for the government, this allowance is gonna be part of your salary when they figure out your taxes. It’s like any other money you earn, they see it, they tax it. But here is the difference, government employees can ask for some discount from the tax. They call it deduction. Don’t ask me why. But there’s a limit to how much you can get off.

- They say it’s like 20% of your basic salary.

- Basic, mind you, not the whole shebang with all the other bonuses and whatnots.

- And there is a maximum amount. I heard it is 5000, but don’t quote me on that.

You see, you can’t just take off as much as you want. It’s not a free-for-all. Them tax folks, they got rules for everything. It is what section 16(ii) said. Yeah, they have these sections and numbers for every rule. As per section 16(ii), that’s the rule for entertainment allowance.

Now, if you ain’t workin’ for the government, this don’t apply to you. You get that allowance, it’s all taxed. No takin’ anythin’ off. No discounts. This is only for government employees. They say it is fair. I don’t know.

This entertainment allowance, it’s supposed to be for work stuff, you know? Like, if a government worker has to take someone important out to dinner to talk about government business, they can use this money. But I bet some folks use it for other things, too. Who’s gonna know, right?

But the tax man, he’s always watchin’. They got their ways of findin’ out if you’re tryin’ to pull a fast one. So, you gotta be careful with this allowance money. Don’t go spendin’ it all on somethin’ silly and then tryin’ to tell the tax man it was for work. They ain’t that dumb.

This whole tax thing, it’s complicated. Even for simple things like this entertainment allowance. There’s always rules and forms and numbers. It gives me a headache just thinkin’ about it. Back in my day, we didn’t have all this fuss. You earned your money, you spent it. No one was stickin’ their nose in your business.

But these days, you gotta keep track of every penny. And if you work for the government, you gotta know these special rules about the entertainment allowance. You get deduction u/s 16(ii), but only some. Otherwise, you’re gonna end up payin’ more taxes than you should. And nobody wants that.

So, you government folks, you better learn these rules. Or find yourself someone who knows about taxes to help you out. It’s a jungle out there in the tax world. You don’t wanna get lost.

They also say that if you are a private employee, you don’t get the deduction. I don’t know why government employees get the deduction. Private employees should get it, too, if they receive entertainment allowance.

In conclusion, whether you work for the government or not, entertainment allowance will be taxed. If you work for the government, you might be able to save some money. But if you are a private employee, well, you have to pay tax for all the entertainment allowance. I think this is all about the entertainment allowance in case of government employee.